The Need for Critical Minerals

The critical mineral requirements within IRA Part 4,1 while essential to achieving a secure supply of materials needed to decarbonize the U.S. transportation sector, are viewed as largely unachievable by many.2 The current-decade timeline and percentage of applicable critical minerals requirements are indeed ambitious. With the processing of battery-grade chemicals being highly concentrated in China and smaller scale production in countries with which the U.S. does not have Free Trade Agreements (FTA), it is possible that the inability for consumers to obtain the proposed Clean Vehicle credit may constrain electric vehicle consumer adoption, making it difficult to meet our shared climate goals. Further, due to raw materials constraints, it is projected that 30 million electric vehicles per year will go unbuilt globally by 20303 unless new, significant sources of supply are developed and brought to market quickly.

Given difficulties advancing domestic mines4 and the timeline of having significant material to recycle,5 establishing strategic partnerships with FTA allies that can offer scalable sources of critical minerals on near-term timelines will be paramount. However, there is currently insufficient production of battery-grade nickel, cobalt and manganese sulphate, key ingredients in stable, long-range batteries, to reach U.S. EV targets. Focusing on nickel given the relative amount per battery required, even if all forecasted nickel sulphate production through 2030 from U.S. and FTA countries went into producing EVs for the United States, less than 60% of the 2030 target would be met. To fully decarbonize by 2035, another U.S. target, domestic and FTA nickel sulphate production would provide only slightly over 10% of required supply.6

Therefore, leaders and policymakers must look to alternatives to reach U.S. electrification targets. Can we produce more from land-based reserves?

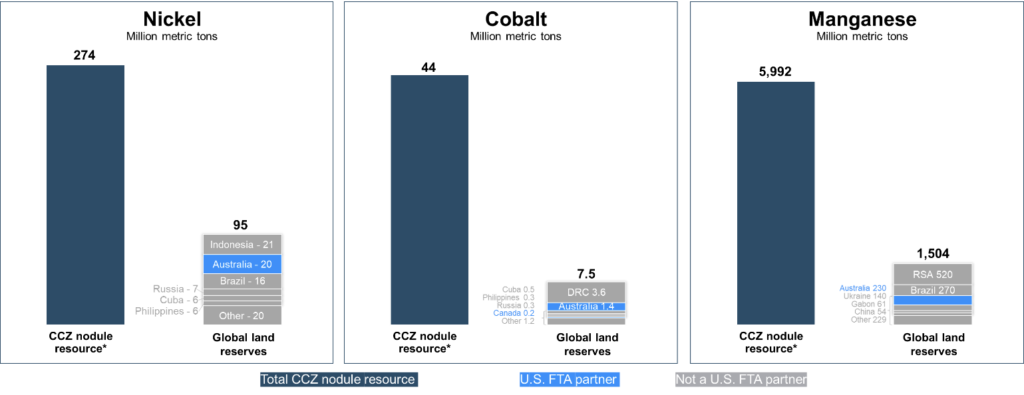

On the timeline of the IRA credits, it will be difficult. Bringing new discoveries of land-based resources to commercial production takes an average of 16-years and given declining ore grades, are often subject to worsening human and environmental impacts including exponential growth of toxic tailings and eroding project economics. This is further complicated by widespread control of key growth markets by Chinese entities via decades of deliberate investment. To this end, a more compelling alternative may be a new abundant source of four key battery metals positioned to become available to the market mid-decade; a variety of allied nations have active exploration contracts for this new metal resource – polymetallic nodules – rocks laying unattached to the seafloor off the coast of North America in the Pacific Ocean. This area, the Clarion-Clipperton Zone (CCZ), contains over three times the amount of cobalt, almost two times the amount of nickel and as much manganese as all global land-based reserves, combined. The U.S. Geological Survey recognizes these sizeable deposits in annual Commodity Summaries and the 100-Day Supply Chain Review noted that “seabed resources may provide a significant future source of strategic and critical materials.”7

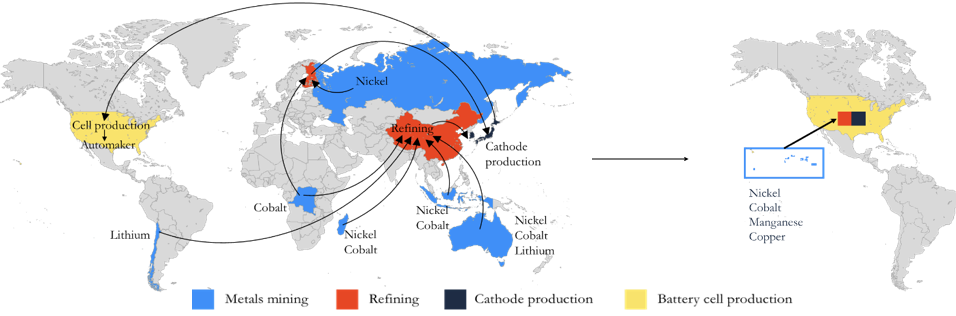

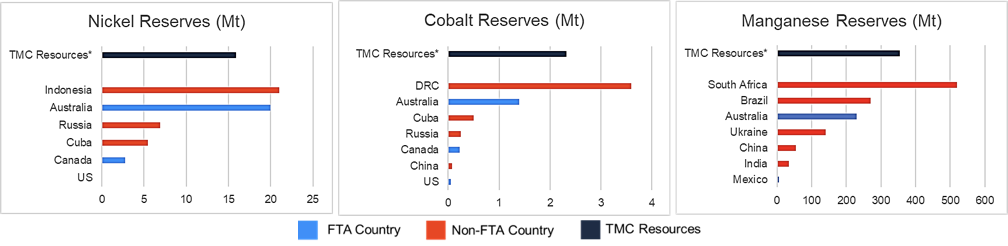

The same report estimated that to fully electrify its vehicle fleet, the U.S. will need 1.27 million and 160 thousand metric tons of battery grade nickel and cobalt per year, respectively, both of which exceed total global production in 2021.7 8 While several FTA countries (Singapore, South Korea) sponsor exploration contracts in the CCZ,9 only one Canadian company anticipates securing a commercial exploitation contract to collect this resource on a timeline consistent with the IRA Clean Vehicle EV credit, as soon as Q4 2024.10 The Metals Company (Nasdaq: TMC) holds rights to three exploration contracts, two of which contain enough in situ nickel, cobalt, manganese, and copper to electrify the entire U.S. passenger fleet, about 280 million vehicles. A strategic partnership with TMC would offer the U.S. the ability to consolidate the upstream battery cathode metal supply chain from 50,000 miles to just 1,500 miles while reshoring critical processing and manufacturing capacity (Figure 2).

Comparing resource bases, TMC’s defined in-situ nickel, cobalt, and manganese across two of its three contract Areas rivals land-based resources of entire countries. It is important to note that global leaders for these land-based critical mineral deposits are not located within FTA countries. While the processing of critical raw materials from leading land-based producers is dominated by China, transporting and processing nodules in the U.S. offers the opportunity for a truly ex-China and -Russia supply chain.

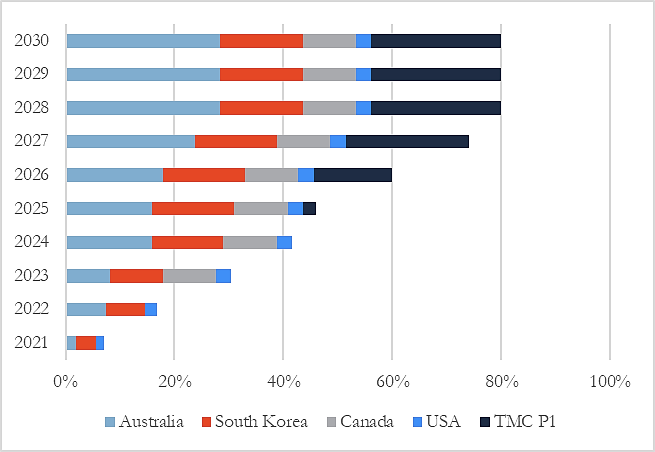

TMC has optimized both collection and processing technologies to establish first small-scale commercial production in 2024 (‘Project Zero’) overseas and full-scale operations (‘Project One’) in the United States in 2026, in line with the timeline of the IRA critical mineral requirements.12 Project One (P1) for which the company is evaluating several U.S. sites, has been designed to produce over 60,000 metric tons of battery grade nickel at steady state production.13 This is over three times Australian and Korean production separately in 2022. Only China produces more today. Further, Project One would produce 6,000 metric tons of cobalt contained in sulfate at steady state production, turning the U.S. into the fourth largest producer globally.

This amount of nickel can be used to produce over 1 million 75kWh electric vehicles per year (NMC811). By comparison, domestic production could only be used to produce approx. 125,000 EVs per year.7, 15 Planned nickel sulfate production from TMC’s Project One would provide almost the same amount of feedstock for EV batteries as using Australia’s entire supply, helping to achieve approx. 25% of the country’s 2030 target of 50% EV penetration.16 TMC is currently evaluating processing partners and investments at company, resource and project levels as it works towards securing facility sites for Project Zero and Project One.

Click here to download a pdf version of this report.

Footnotes

1 https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-117SAHR5376.pdf

2 MIT Technology Review EV tax credits could stall out on lack of US battery supply, Aug 2022; Atlantic Council, The Inflation Reduction Act places a big bet on alternative mineral supply chains, Aug 2022

3 Battery Materials Review _____

4 MSCI Mining Energy-Transition Metals: National Aims, Local Conflicts, June 2021; Reuters Rio Tinto’s 26-year struggle to develop a massive Arizona copper mine, Apr 2021; Washington Post Biden administration cancels two mining leases near Minnesota wilderness, Jan 2022; NBC News The cost of green energy: The nation’s biggest lithium mine may be going up on a site sacred to Native Americans, Aug 2022.

5 Nature Reviews Earth & Environment Deep- ocean polymetallic nodules as a resource for critical materials, March 2020.

6 Sources: (For US Demand) Table 1. Page 97 of 100-Day Reviews under Executive Order 14017, June 2021; (For nickel sulphate supply through 2032) Benchmark Mineral Intelligence Nickel Forecast, Q4 2021; (For nickel requirements per EV) AMY July 25, 2018: Table 1, applied to 75kWh battery pack.

7 100-Day Reviews under Executive Order 14017, June 2021: page 254, footnote 3.

8 Benchmark Mineral Intelligence Nickel Forecast, Q4 2021; BNEF Cobalt Outlook, 2021.

9 https://www.isa.org.jm/exploration-contracts/polymetallic-nodules

10 https://www.isa.org.jm/news/nauru-requests-president-isa-council-complete-adoption-rules-regulations-and-procedures

11 Bloomberg, Sept 9, 2021.

12 NORI SEC filing

13 Preliminary Economic Assessment of the NORI Area D, AMC Consultants, April 2019.

14 Calculated based on nickel content required for NMC811 battery cathode per AMY July 25, 2018: Table 1 Battery metal value per kWh.

15 While studies are underway, the only other developing nickel mine in the U.S., Tamarack in Minnesota, has not completed flowsheet development towards nickel sulfates and has not yet begun environmental permitting. Sources: Preliminary Economic Assessment of the Tamarack North Project March 12, 2020; https://www.newswire.ca/news-releases/electra-glencore-and-talon-partnering-with-government-of-ontario-on-battery-materials-park-study-807167832.html

16 President Biden Announces Steps to Drive American Leadership Forward on Clean Cars and Trucks, Aug 2021.