Vancouver, Canada – June 10, 2021- The Metals Company (formerly DeepGreen Metals), a Canadian explorer of lower-impact battery metals from seafloor polymetallic nodules, today welcomed the findings of the White House’s comprehensive 100-day review addressing supply chain challenges and outlined how its plans can make a material contribution to re-shoring American supply chains for the critical minerals needed for batteries.

The challenges outlined by The Metals Company in its recent response to the Department of Energy’s Request for Information that followed an earlier Executive Order, include an insufficient and highly concentrated supply of battery metals, rising costs, and the growing environmental and social impact footprint for sourcing these minerals through land-based mining.

“The Biden Administration has rightly recognized that a stable and secure battery supply chain is paramount to maintaining American economic prosperity and national security. Declaring nickel as one of the top three most critical minerals for batteries and including processing of battery metals in the $17b Advanced Technology Vehicles Manufacturing Loan Program is an important step for the United States to start building mineral independence while taking a more prominent role in the clean energy transition,” said Gerard Barron, Chairman and CEO of The Metals Company, which announced in March that it would merge with Sustainable Opportunities Acquisition Corporation (NYSE: SOAC).

With relevance to The Metals Company, the report made the following recommendations and observations:

- Elevation of nickel to ‘critical’ status – The report explicitly cites nickel 146 times, singling it out as one of three battery metals deemed “most critical” to US interests, alongside cobalt and lithium. Polymetallic nodules contain rich concentrations of nickel and cobalt, as well as copper and manganese, and are effectively a ‘battery in a rock”

- Expanded government funding scope for critical mineral processing in the U.S. – The Department of Energy’s $17 billion Advanced Technology Vehicle Manufacturing (ATVM) Loan Program has been expanded to provide access to suppliers involved in critical mineral refining and processing. As reported by Reuters, the establishment of domestic nickel refining capacity was the highest priority outlined in the Biden administration’s 100-day supply chain review.

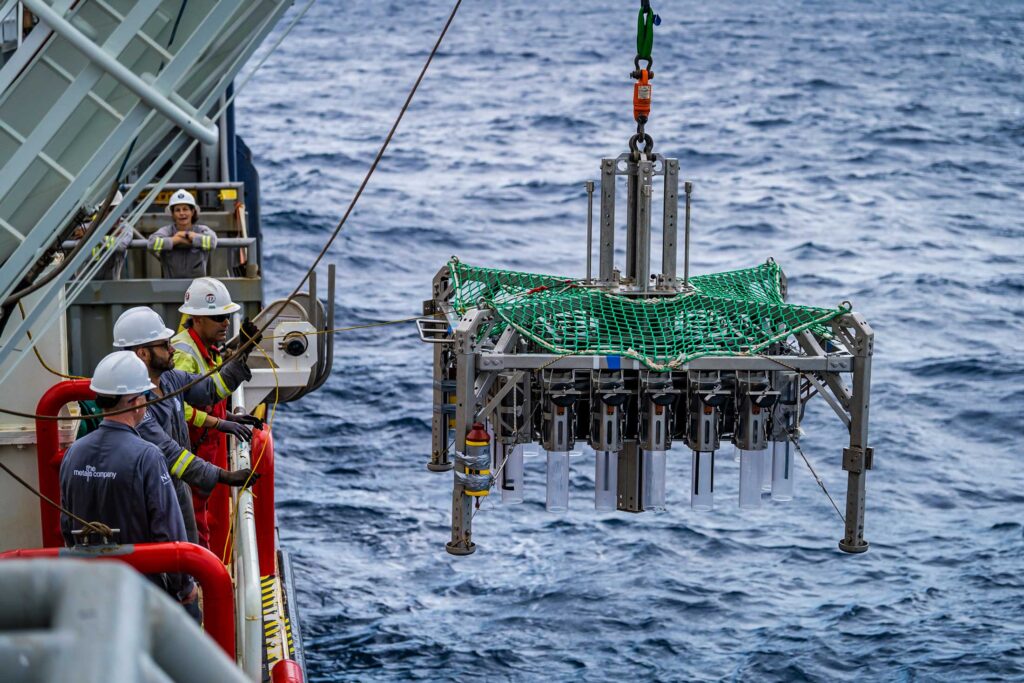

- Potential of seafloor minerals – While not covered directly in the report, the authors noted that “seabed resources may provide a significant future source of strategic and critical materials,” with additional value derived from “dual-use technology development associated with unmanned undersea vessels and hydrographic mapping.”

- U.S. must invest in sustainable extraction and processing of critical minerals, at home and abroad.

- Lying unattached on the seafloor, nodules can be collected without drilling or blasting.

- Compared to land ores, polymetallic nodules can reduce the lifecycle environmental and social impacts of battery metal production by between 70–99%.

- Nodules can be shipped anywhere in the world for processing with zero solid waste and no toxic tailings, bringing an abundant, lower-impact supply of battery metals to America’s doorstep.

- Work with allies and partners to diversify supply chains – China has effective control over land-based supplies of critical minerals, and through its investments in Indonesia will soon control 60% of nickel supply, and nearly all new nickel supply growth through guaranteed offtake agreements. However, China has yet to corner the market in seafloor resources like polymetallic nodules.

- Reform and strengthen U.S. stockpiles – The report recommended that the Administration and Congress “recapitalize and restore the National Defense Stockpile of critical minerals” including nickel, cobalt, and manganese to safeguard access for domestic end-users.

Contacts

Media | The Metals Company | rory@metals.com

Investors | investors@metals.co